Generally, 1 000 000 coins of the standard ERC20 will be issued on the previous token sale. Coins Credits can not be extracted for extraction.

CREDITS

is a new open source platform for creating and managing financial services based on Creditchain / Book Credit. The principle of implementing intellectual agreements and a compatible voting system creates a unique opportunity for all participants to interact with different financial products. The platform opens a new market and has the potential to use projects and services blockade in the financial industry and other industries, which previously was unsuitable due to speed and transaction delays. A unique block-based system allows users to build high-speed transaction finance services at up to 100 million per second, with an average transaction speed of 3 seconds. CREDITS really offers new opportunities for using the blockade technology in the financial industry.

To create a new platform for the work of financial products, the unique methodology for building a chain with intelligent contracts / registry can be achieved:

- Ability to process a transaction up to 1 million times per second

- Average transaction processing time for 3 seconds

- Very small commissions or almost their absence

BITCOIN / ETHEREUM

- Approximately 100 transactions per second

- The average transaction time is from 0.5 to 15 minutes

- The transaction cost is from 0.02 to 0.5 $

Popular platforms are not suitable for financial transactions because the transaction is performed very slowly, and the transaction value is from 0.02 to 0.5 $. The financial industry is currently unsuitable for this. CREDITS is designed to achieve a million transactions per second with an average transaction processing time of 3 seconds and an average peak of 10 seconds.

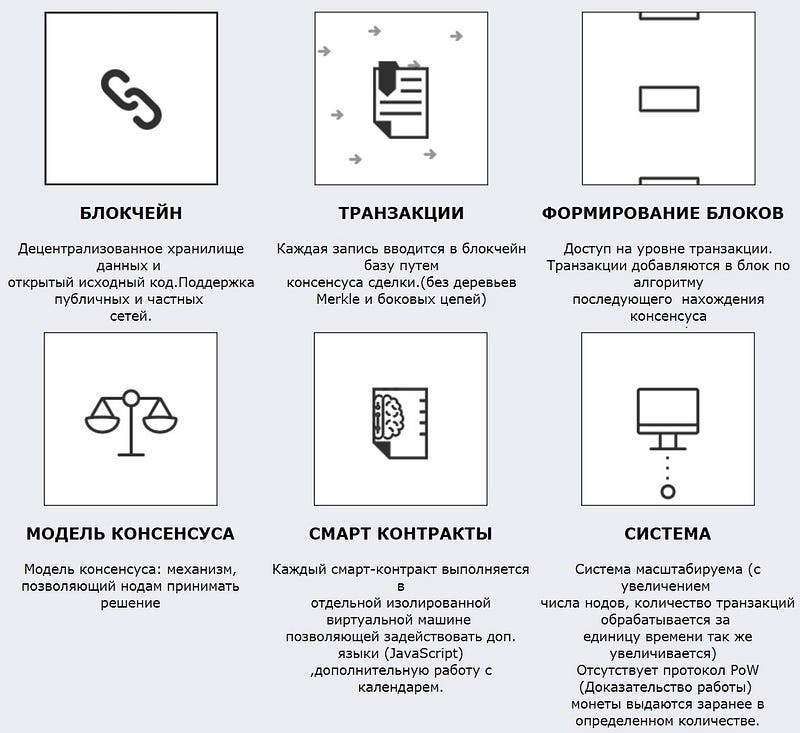

The system is a distributed database with the principle of block cache / bookger - management and transaction of distributed digital assets.

The CREDITS platform provides the implementation of a new, unique blockade technology, intelligent contracts, data protocols, and has its own internal encrypted currency. This platform with new features of network technologies, speed and number of transactions per second. This is an open platform, which means that users and companies will be able to use chain-to-end transactions to create online services.

Command :

Conducting ICO CREDITS

The ICO is conducted with the goal of further developing, maintaining and promoting the CREDITS platform.

The funds that will be collected from the sale of tokens will be spent for the following purposes:

CREDITS platform software development with smart contracts and cryptography.

The share will be allocated for general administrative, operational, capital, marketing and other expenses of the company

Fund for project support on the platform and CREDITS crypt.

The ICO will take place on the Ehereum platform in the ERC20 standard. CREDITS tokens after ICO 0 will be listed on the stock exchange in accordance with the Road Map.

CREDITS digital tokens will be released in limited quantities. All CREDIT markers must have the same functionality.

With the goal of launching the project, the company holds 2 rounds of ICO.

• ICO Round 1 in November - December 2017.

• ICO Round 2 in Q2 2018.

The total amount of tokens is 1 000 000 000.

The total expected sales of multi-round tokens is 200,000 ETH. Not sold tokens will be burned.

- Bounty program 2%

- Post Bounty 2%

- Followers 15%

- Development of 5%

- Advisers 1%

- Pre-ICO and ICO 75%

After releasing the Beta platform version, the ERC20 tokens will be changed to CREDITS crypto currency.

You can find out more information by going through the links below:

Website: https://credits.com/en

Whitepaper: https://credits.com/Content/Docs/Technical

WhitePaperCREDITSEng.pdf

Twitter: https: https://twitter.com/CreditsCom

Facebook: https://www.facebook.com/Creditscom-1488549834790421/

Telegram: https://t.me/creditscom

ICO: https://credits.com/en/home/ico

Author : (aizkicaumania)

https://bitcointalk.org/index.php?action=profile;u=1123133

Tidak ada komentar:

Posting Komentar